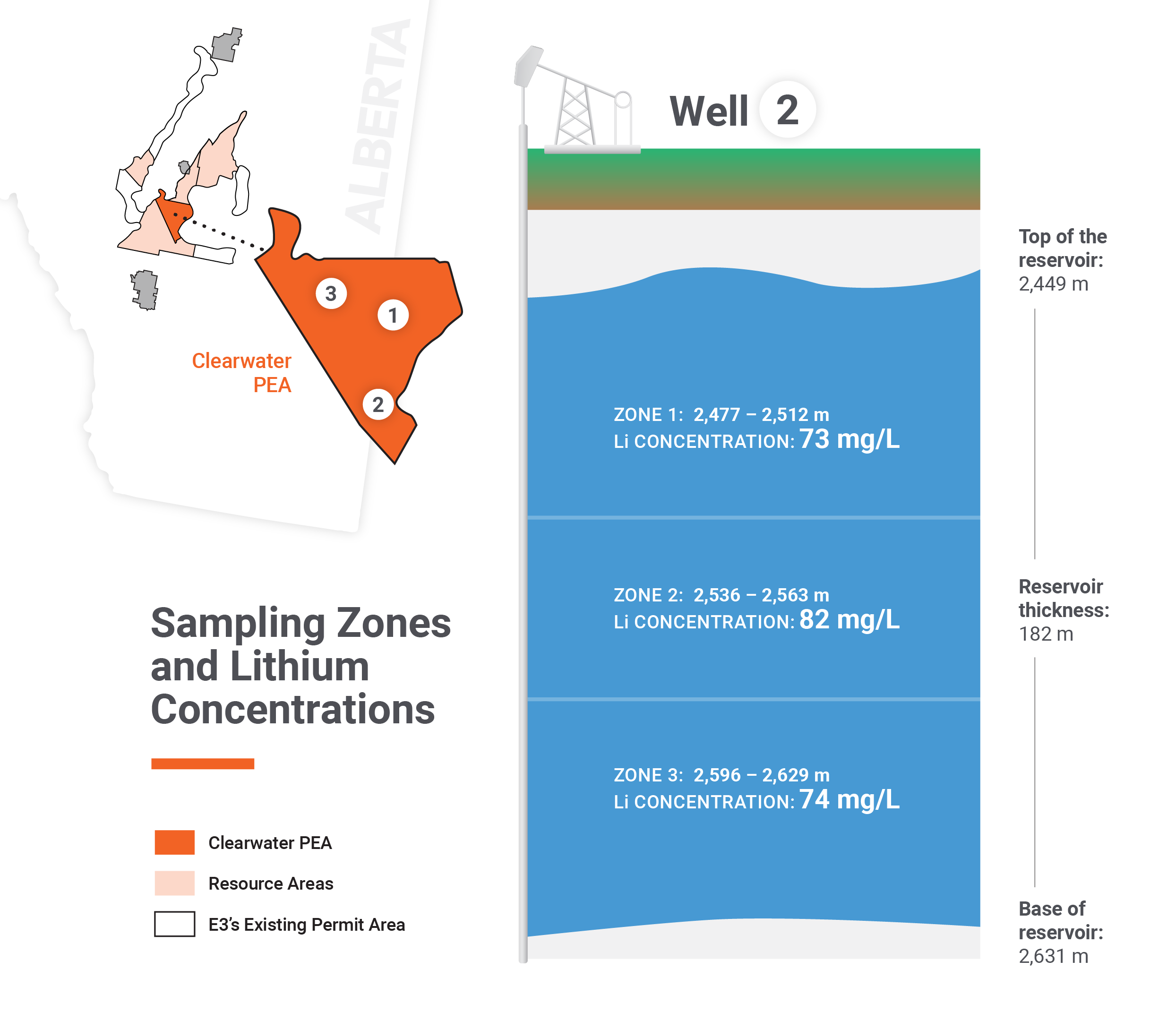

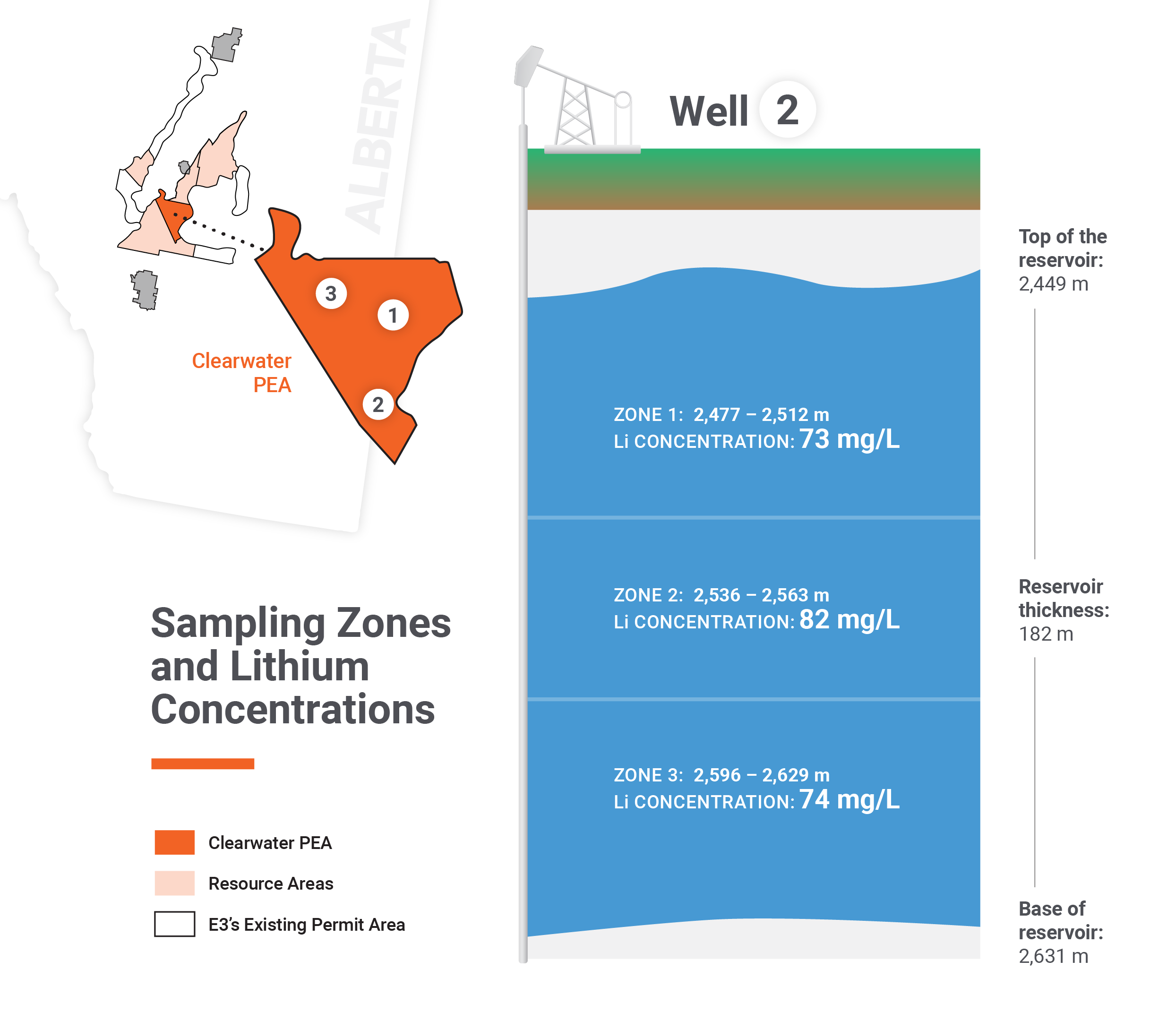

CALGARY, ALBERTA, January 4, 2023 – E3 LITHIUM LTD. (TSXV: ETL) (FSE: OW3) (OTCQX: EEMMF), Alberta’s leading lithium developer and extraction technology innovator, is pleased to share that the sample results from its second well are consistent with the lithium concentrations from its first well and the historic results across the Leduc Reservoir.

The second well, located approximately 20 kilometres south of the first well in the Clearwater Project Area in the Bashaw District, was drilled in the summer of 2022. Based on brine samples retrieved from three zones, the P501 lithium concentration from E3 Lithium’s (E3) second well is 74 mg/L. Please see Figure 1 for the zone intervals and concentration results.

“The consistency of lithium across our reservoir as demonstrated through our first two wells is critical to the confidence in our understanding of this resource and our plans for upgrading to Measured and Indicated,” said Chris Doornbos, President and CEO of E3 Lithium. “The third and final well associated with our 2022 drill program was repurposed from an existing oil and gas well; the sampling program was completed in December with concentration results anticipated soon.”

Figure 1: Sampling Intervals and Lithium Concentrations from E3 Lithium’s Second Well

The brine samples were analyzed by a third-party certified laboratory, following independently verified sample acquisition procedures that maintained a strict chain of custody, in accordance with The Canadian Institute of Mining, Metallurgy and Petroleum (CIM) guidelines.

Read E3’s November 10, 2022 news release for the concentration results of its first well.

_________________

174 mg/L is the P50 result from E3 Lithium’s second well. A P50 estimate indicates there is a 50% probability that quantities recovered will equal or exceed the P50 value.

E3 Lithium - Investor and Media Relations

Robin Boschman

Director, External Relations

investor@e3lithium.ca

587-324-2775

About E3 Lithium

E3 Lithium is a development company with total of 24.3 million tonnes of lithium carbonate equivalent (LCE) inferred mineral resources1 in Alberta. As outlined in E3’s Preliminary Economic Assessment, the Clearwater Lithium Project has an NPV8% of USD 1.1 Billion with a 32% IRR pre-tax and USD 820 Million with a 27% IRR after-tax1. Through the successful scale up its DLE technology towards commercialization, E3 Lithium’s goal is to produce high purity, battery grade lithium products. With a significant lithium resource and innovative technology solutions, E3 Lithium has the potential to deliver lithium to market from one of the best jurisdictions in the world.

ON BEHALF OF THE BOARD OF DIRECTORS

Chris Doornbos, President & CEO

E3 Lithium Ltd.

1: The Preliminary Economic Assessment (PEA) for the Clearwater Lithium Project NI 43-101 technical report is effective Sept 17, 2021. The mineral resource NI 43-101 Technical Report for the North Rocky Property, effective October 27, 2017, identified 0.9Mt LCE (inferred). The mineral resource NI 43-101 Technical Report for the Bashaw District Project, effective July 11, 2022, identified 23.4Mt LCE (inferred). All reports are available on the E3 Lithium’s website (e3lithium.ca/technical-reports) and SEDAR (www.sedar.com).

Forward-Looking and Cautionary Statements

This news release includes certain forward-looking statements as well as management’s objectives, strategies, beliefs and intentions. Forward looking statements are frequently identified by such words as “may”, “will”, “plan”, “expect”, “anticipate”, “estimate”, “intend” and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the effectiveness and feasibility of emerging lithium extraction technologies which have not yet been tested or proven on a commercial scale or on the Company’s brine, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.